homedesignlatest.site

Gainers & Losers

Environmentally Conscious Investing

ESG investments may also be referred to as sustainable investments, impact aware investments, socially responsible investments or diversity, equity, and. On the other hand, socially responsible investing (SRI) focuses on investing in companies that match specific social or ethical values. For example, SRI. ESG investing is an approach that considers factors beyond risk and return, like climate change, labor management, corporate governance, and many others. Common themes for socially responsible investments include avoiding investment in companies that produce or sell addictive substances (like alcohol, gambling. Green investing is the act of investing money into companies that have eco-friendly practices and sustainable business models. Anyone can get started with green. Rounding it up · Green investing is the act of investing money into companies that have eco-friendly practices and sustainable business models. · Anyone can get. Conscious investments rely on the assessment of environmental, social, and governance (ESG) criteria. As the demand for sustainable investment options grows, green bonds have become an attractive option for eco-conscious investors. Green bonds. Environmental, social, and governance (ESG) investing refers to a set of standards that socially conscious investors use to screen investments. ESG investments may also be referred to as sustainable investments, impact aware investments, socially responsible investments or diversity, equity, and. On the other hand, socially responsible investing (SRI) focuses on investing in companies that match specific social or ethical values. For example, SRI. ESG investing is an approach that considers factors beyond risk and return, like climate change, labor management, corporate governance, and many others. Common themes for socially responsible investments include avoiding investment in companies that produce or sell addictive substances (like alcohol, gambling. Green investing is the act of investing money into companies that have eco-friendly practices and sustainable business models. Anyone can get started with green. Rounding it up · Green investing is the act of investing money into companies that have eco-friendly practices and sustainable business models. · Anyone can get. Conscious investments rely on the assessment of environmental, social, and governance (ESG) criteria. As the demand for sustainable investment options grows, green bonds have become an attractive option for eco-conscious investors. Green bonds. Environmental, social, and governance (ESG) investing refers to a set of standards that socially conscious investors use to screen investments.

Fidelity® Environment & Alternative Energy Fund (FSLEX) Focuses on alternative and renewable energy, energy efficiency, pollution control, water. Rounding it up · Green investing is the act of investing money into companies that have eco-friendly practices and sustainable business models. · Anyone can get. Greenvest provides personal consulting on socially responsible investing, plus the universe of socially responsible investments to support your beliefs. Responsible investment (RI) refers to the incorporation of environmental, social and governance factors (ESG) into the selection and management of investments. Responsible investment involves considering environmental, social and governance (ESG) issues when making investment decisions and influencing companies or. Common types of eco-friendly investments include green bonds, sustainable stocks, clean energy funds, socially responsible mutual funds and ETFs, impact. What is Socially Responsible Investment (SRI)? · Socially responsible investment, or SRI, is a strategy that considers not only the financial returns from an. At Amalgamated Investment Services, we're dedicated to helping you create a plan for your financial future that meets your goals, fits your budget and. Sustainable investing balances traditional investing with environmental, social, and governance-related (ESG) insights to improve long-term outcomes. What Is ESG Investing & What Are ESG Stocks? ESG investing is a form of socially responsible investing that prioritizes financial returns and emphasizes a. Sustainable investing enables you to invest your money in a socially conscious way according to your personal preferences and values. Responsible investing (RI) is an approach that integrates material environmental, social and governance (ESG) factors, alongside traditional financial criteria. Socially responsible investing is your opportunity to make a difference with every dollar you invest in your future. It doesn't mean that you have to give up. Sustainable Investing is growing exponentially as more investors and 5The Extel & SRI Connect Independent Research in Responsible Investment. Sustainable investing is an investment approach that uses environmental, social, and corporate governance criteria. Explore our insights and see how you can. ESG investing, which typically assesses the factors listed below, offers a way for you to invest in funds that consider environmental, social, and governance. ESG investing may reduce the risk of owning companies that show up in the headlines for environmental catastrophes, fraudulent behavior, etc. While the overall. With this growth has come an expanding menu of choices for investors looking to adopt sustainable investment strategies. BlackRock offers a robust suite of. Socially responsible investing (SRI) is any investment strategy which seeks to consider financial return alongside ethical, social or environmental goals. The. Eco-investing or green investing is a form of socially responsible investing where investments are made in companies that support or provide environmentally.

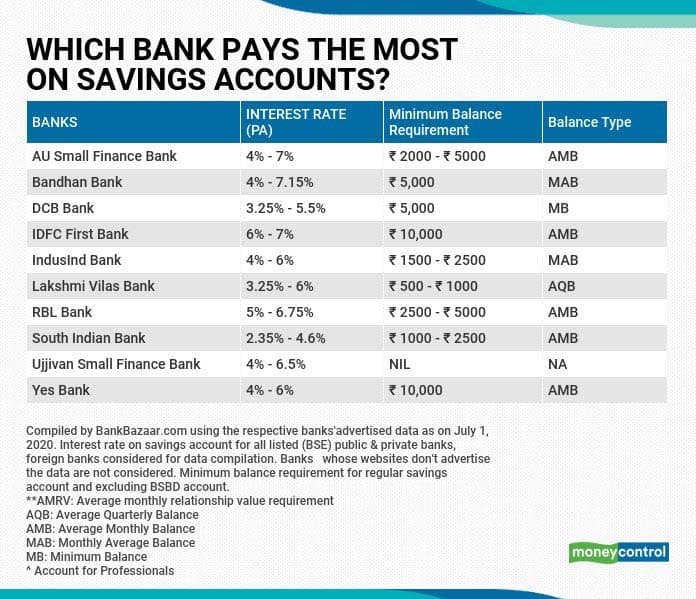

Banks With Great Savings Rates

TAB Bank offers a high-yield savings account with % APY—more than 11 times the national average. You only need $ on deposit to earn this rate and there. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Best High-Yield Savings Accounts of September Up to % ; SoFi Checking and Savings · SoFi Checking and Savings · at SoFi Bank, N.A., Member FDIC. TRACK YOUR SAVINGS ON-THE-GO. Easy account transfers. Move your money between linked Capital One accounts or external bank. REMINDER · Earn over 10x the national average* with a High Yield Savings rate of % Annual Percentage Yield · An Award Winning Bank · Smarter. Simpler. Better. Online savings accounts Higher savings rates are back You'll find some of the best savings rates out there - right here · % APY · % APY · % APY · Which. Our picks at a glance ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ ; LendingClub Bank High-Yield Savings. Up to. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of. Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub LevelUp Savings · Best for no minimum. TAB Bank offers a high-yield savings account with % APY—more than 11 times the national average. You only need $ on deposit to earn this rate and there. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Best High-Yield Savings Accounts of September Up to % ; SoFi Checking and Savings · SoFi Checking and Savings · at SoFi Bank, N.A., Member FDIC. TRACK YOUR SAVINGS ON-THE-GO. Easy account transfers. Move your money between linked Capital One accounts or external bank. REMINDER · Earn over 10x the national average* with a High Yield Savings rate of % Annual Percentage Yield · An Award Winning Bank · Smarter. Simpler. Better. Online savings accounts Higher savings rates are back You'll find some of the best savings rates out there - right here · % APY · % APY · % APY · Which. Our picks at a glance ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ ; LendingClub Bank High-Yield Savings. Up to. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of. Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub LevelUp Savings · Best for no minimum.

Many banks now offer high-yield savings accounts with rates above %. That's far above the average rate of a traditional savings account: currently %. The interest rates and Annual Percentage Yields displayed here are for the Wells Fargo Bank locations in the California counties of Alameda, Contra Costa, Marin. Benefits of our High-Yield Online Savings Account · Open Your Account in Minutes · Manage Your Finances - Anytime, Anywhere · Streamlined Banking Experience. Personal banking rates. When we say we have your best financial interest in mind, we mean it. Visit here any time to see what you could be earning. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. Sallie Mae named one of the best savings accounts, money market accounts and CDs for GOBankingRates named Sallie Mae as one of the top online banks. Visit Citizens to compare savings accounts and choose the best for your goals. From CDs to MMAs and general savings accounts, Citizens offers a variety of. homedesignlatest.site has many banks to pick from. Right now rates for HYSA are up to % and 3 month CDs are %. The current mobile daily deposit limit is $2, per account. Note: Please ensure to endorse the back of the check. Direct deposit from a third party, for. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. Best Savings Accounts – September ; UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings · %. I use Western Alliance Bank online with an APY of Us this referral and get $ James C. is giving you a cash bonus and helping you save! Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. High Yield Savings Account Rates ; Interest Rate%, Annual Percentage Yield (APY)%, Minimum Balance to Open$50,, Minimum to Earn APY$50, ; Interest. The top savings accounts rates on Raisin. Offered by FDIC-insured banks and NCUA-insured credit unions. Start with as little as $1 and no fees. Learn more. Earn more with % APY63 (that's 15x the bank industry average!71). And with fewer fees, rest easy knowing your money will stay your money. Move. With technology rivaling any size bank, open the best online savings account today and start growing your savings Great interest rates.” Jonathan B., Astoria. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. The Annual Percentage Yield (APY) is accurate as of 9/4/ rates are variable and are subject to change without notice. The My Banking Direct High Yield. Earn up to % interest per annum, with monthly credit on your savings account. Maximize your savings with IDFC FIRST Bank's competitive interest rates.

Is It Worth Installing Solar Panels

Solar is worth it for most homeowners because it eliminates or significantly reduces your electric bill. It's most helpful to think about solar panels as an. Each $1 in energy bill savings (from your solar install) adds $20 to your home's total value. There are still good rates of return for solar installations in. Homeowners who install solar power systems can receive numerous benefits: reduced electric bills, lower carbon footprints, and potentially higher home values. So, is solar worth it? Solar can save you a great deal of money over time. Installing a solar system is a smart investment for many reasons. It can offset or. Solar panels are worth it for most homeowners, as long-term savings and increases in property value make up for the high initial installation costs. · Whether. Installing a properly sized renewable energy system in Florida can eliminate a homeowner's entire electricity bill! For the average Florida resident, that's. The major question around solar panels is whether installing solar panels worth it. The answer is YES. Solar panels have a lot of benefits apart from reducing. The price of solar panels is at a record low, with an average-sized 10kW solar system with good quality solar panels now costing as little as $$ fully. I have found that solar panels are definitely worth the cost. · Just over 2 years ago, my son and I installed 26 solar panels on my house. · My. Solar is worth it for most homeowners because it eliminates or significantly reduces your electric bill. It's most helpful to think about solar panels as an. Each $1 in energy bill savings (from your solar install) adds $20 to your home's total value. There are still good rates of return for solar installations in. Homeowners who install solar power systems can receive numerous benefits: reduced electric bills, lower carbon footprints, and potentially higher home values. So, is solar worth it? Solar can save you a great deal of money over time. Installing a solar system is a smart investment for many reasons. It can offset or. Solar panels are worth it for most homeowners, as long-term savings and increases in property value make up for the high initial installation costs. · Whether. Installing a properly sized renewable energy system in Florida can eliminate a homeowner's entire electricity bill! For the average Florida resident, that's. The major question around solar panels is whether installing solar panels worth it. The answer is YES. Solar panels have a lot of benefits apart from reducing. The price of solar panels is at a record low, with an average-sized 10kW solar system with good quality solar panels now costing as little as $$ fully. I have found that solar panels are definitely worth the cost. · Just over 2 years ago, my son and I installed 26 solar panels on my house. · My.

Harnessing solar power for your home is a competitive venture that may have a better return on investment (ROI) than other financial investments. While there are many variables that impact the cost, savings and payback of solar panels, the upshot is that in Australia they are a good investment. Typically. Solar PV modules will help you lock in your current electricity rates for 25+ years. Hence, your utility bill will remain the same even if the electricity rates. Improved home value. Installing solar panels typically increases the overall value of your home. Solar panels can add around $15, of value to your home and. Solar panels are almost always worth it if you own your home and have an electric bill. How much money you can save varies for every property. Homeowners who install solar power systems can receive numerous benefits: reduced electric bills, lower carbon footprints, and potentially higher home values. Solar panels reduce your carbon footprint, improve your energy efficiency, and lower the cost of your utility bills. In the right conditions, they can save you. Yes, solar panels are worth it. They can help you save between £ and £ per year on your electricity bills. At the same time, they generate free. Today's premium monocrystalline solar panels typically cost between $1 and $ per Watt, putting the price of a single watt solar panel between $ and. Most people simply do not have the money to fund the installation of solar panels on their own home. An easier and cheaper way to switch from non-renewable. They could increase your property value. Homes with solar panels can sell for more than those without, as potential buyers are attracted by the savings and eco-. It depends on electricity rates in your state. Today return on investment will be from 5 % for residential but after years once solar reaches grid. Installing solar panels means reducing your dependence on fossil fuels, meaning you'll reduce your carbon footprint, emissions and pollution by converting to. So for many Americans, the answer to “Are solar panels worth it?” is a resounding yes! In fact, the United States currently has enough solar power capacity to. Are solar panels worth it? If you are a homeowner who wants to make your home more energy-efficient and eco-friendly, solar panels can be a great investment. One of the most significant benefits enjoyed by solar customers is the fact that panels may increase home value. In fact, in a recent EcoWatch solar survey, 63%. The average cost of a residential solar panel system in the United States ranges from $20, to $25, before tax credits and incentives. This. Installing solar panels offers a remarkable benefit: they typically pay for themselves over time. To determine how long this process will take for your home or. Buying a solar energy system will likely increase your home's value. A recent study found that solar panels are viewed as upgrades, just like a renovated. Solar Panel Installation in Clearwater, FL. So if you're still wondering if solar panels are worth installing and you want more information about solar panel.

Vpn For Binance

Short on Time? Here Are the Best VPNs for Binance in ExpressVPN — The best VPN for Binance with lightning-fast servers in many locations worldwide that. CyberGhost is the best VPN service in With blazing fast servers, it offers top privacy for all devices, Windows, iOS, Mac, Android, or Linux. This guide will show you how to buy Wallet VPN by connecting your crypto wallet to a decentralized exchange (DEX) and using your Binance account to buy the. How to Access Binance with VPN? · Find a secure VPN with access to at least 50 countries. · Check if you can use the VPN on several devices at once and even when. Best VPN for Binance: Our Top 3 Favorite Services · 1. ExpressVPN · 2. CyberGhost · 3. NordVPN. NordVPN Encryption © NordVPN. Binance's terms of service explicitly state that the use of VPNs to access its platform is not permitted. VPNs are often used to mask a user's. 1. ExpressVPN The best VPN for Binance is ExpressVPN and there are many reasons for that. First, it has 3,+ servers in countries globally, making it. NordVPN offers the most flexibility of the VPNs we tested. · Surfshark is the only VPN on our list that allows you to connect to its servers on unlimited devices. Short on Time? Here Are the Best VPNs for Binance in ExpressVPN — The best VPN for Binance with lightning-fast servers in many locations worldwide that. Short on Time? Here Are the Best VPNs for Binance in ExpressVPN — The best VPN for Binance with lightning-fast servers in many locations worldwide that. CyberGhost is the best VPN service in With blazing fast servers, it offers top privacy for all devices, Windows, iOS, Mac, Android, or Linux. This guide will show you how to buy Wallet VPN by connecting your crypto wallet to a decentralized exchange (DEX) and using your Binance account to buy the. How to Access Binance with VPN? · Find a secure VPN with access to at least 50 countries. · Check if you can use the VPN on several devices at once and even when. Best VPN for Binance: Our Top 3 Favorite Services · 1. ExpressVPN · 2. CyberGhost · 3. NordVPN. NordVPN Encryption © NordVPN. Binance's terms of service explicitly state that the use of VPNs to access its platform is not permitted. VPNs are often used to mask a user's. 1. ExpressVPN The best VPN for Binance is ExpressVPN and there are many reasons for that. First, it has 3,+ servers in countries globally, making it. NordVPN offers the most flexibility of the VPNs we tested. · Surfshark is the only VPN on our list that allows you to connect to its servers on unlimited devices. Short on Time? Here Are the Best VPNs for Binance in ExpressVPN — The best VPN for Binance with lightning-fast servers in many locations worldwide that.

Find step by step guide with video instructions on how to buy homedesignlatest.site (VPN) on Binance. Our platform offers the lowest fees and highest security to buy. I've found the best VPNs for Binance after weeks of testing numerous VPNs. My top choice is ExpressVPN, as it has a vast server network, top-notch security. Binance may notice people logging from the same ip range, making sure if its a VPN server and adding that to a blacklist. Trade crypto securely anywhere with the best Binance VPN. Access Binance globally, enjoy fast speeds, and robust security. Get started now! 6 Best VPN for Binance Trading · 1. NordVPN · 2. ExpressVPN · 3. CyberGhost · 4. PrivateVPN · 5. SurfShark · 6. IPVanish · 14 Day Free Trial. This guide will show you how to buy Wallet VPN by connecting your crypto wallet to a decentralized exchange (DEX) and using your Binance account to buy the. When using Binance, it's essential to employ a dependable and trustworthy virtual private network (VPN) like NordVPN to protect your valuables. ExpressVPN is the best VPN for crypto, helping you stay secure and private online for Bitcoin and other cryptocurrency transactions. Please, which VPN is working for Binance in Nigeria? Help a broke Nigerian. Think of a VPN for Binance as your trusty sidekick in the world of cryptocurrency trading. It's all about keeping your online activities secure and giving. Here's a step-by-step instruction on how to unlock Binance cryptocurrency exchange from any part of the world. A credible VPN service provides access to Binance's full features and encrypts your internet traffic, prioritizing your privacy. Setting up a VPN for Binance can enhance your security and privacy while accessing the platform from various locations. NordVPN is a fast and secure VPN service with a range of unique features. It's one of the most secure VPNs out there, combining AES encryption with an ad. Data security. Use a VPN for an additional layer of personal data protection and financial transaction security. Although Binance claims a high level of. use widevpn to login to Binance to sell and withdraw,change USA IP homedesignlatest.site homedesignlatest.site Bitcoin is the only cryptocurrency available for VPN purchases. Has a day money-back guarantee on all purchases, including those made with Bitcoin. Compared. Private VPN servers with dedicated IP address powered by OpenVPN, WireGuard® and Shadowsocks protocols. Binance Coin (BNB) & other cryptocurrencies accepted. To access the service, a user establishes a secure and active connection with a remote server owned by a VPN provider. The server creates an encrypted pathway. Binance, the world's leading cryptocurrency exchange, is currently facing access restrictions for users in Venezuela when accessing the web platform through.

Whats Trade Options

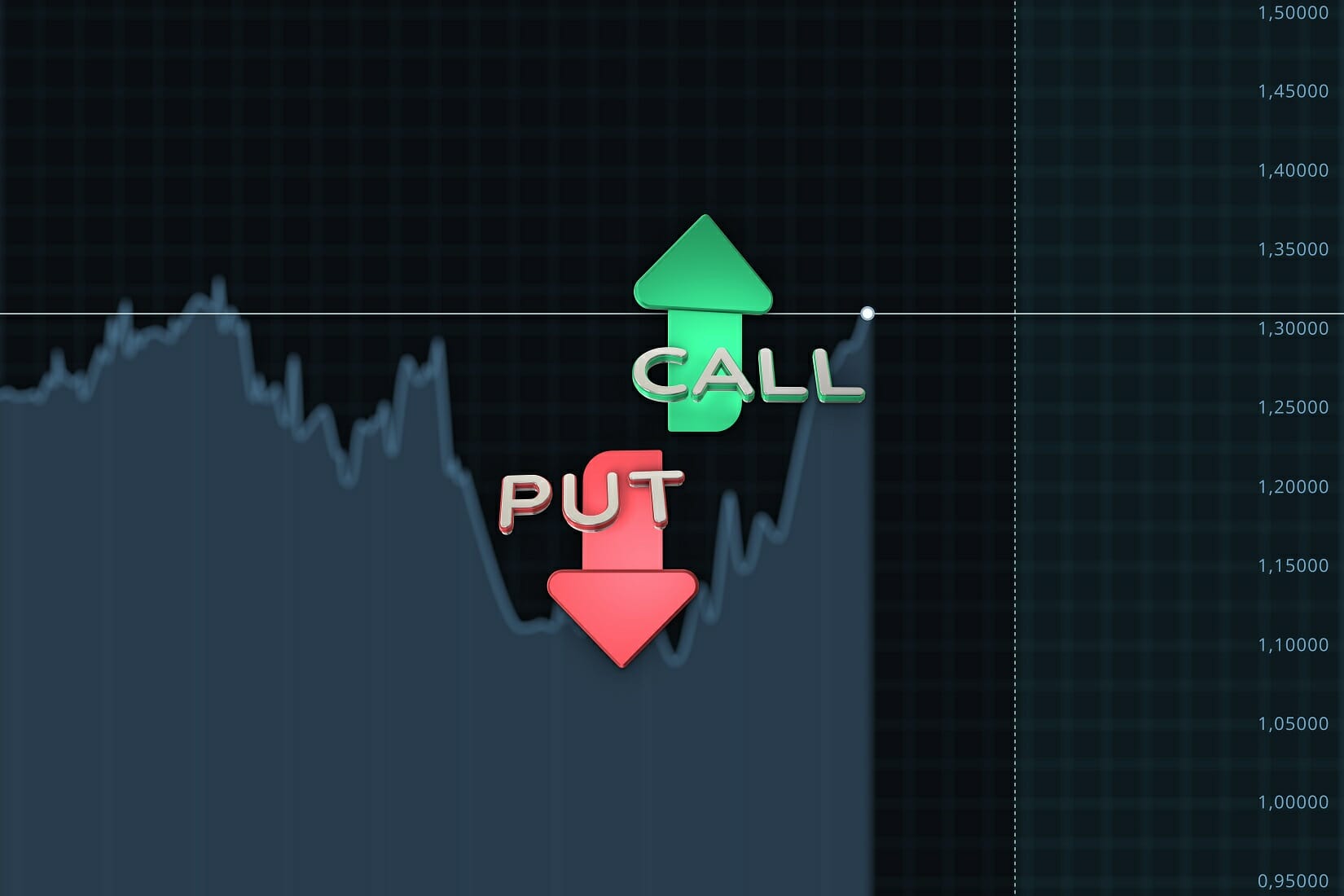

What is Options Trading? Options trading gives traders more ways to seek opportunities within the asset market. They're a relatively advanced strategy. What are the four basic options strategies? · Long call option: you pay a fixed premium for the right to buy a market at the strike price. · Short call option. Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Choose a strategy. Enter your order. Manage your position. We'll help you build the confidence to start trading options on the E*TRADE web platform or our Power. Options trading is the act of buying and selling options. These are contracts that give the holder the right, but not the obligation, to buy or sell an. Capital Outlay & Cost Efficiency; Risk & Reward; Flexibility & Versatility; Disadvantages of Trading Options. Section Contents Quick Links. Definition. What options are. They are contracts that let you buy or sell an underlying asset (like a stock or ETF). For example, the buyer of an Apple call has. The list below includes some major stocks and exchange-traded funds (ETFs) with heavy options volume. It ranks symbols by their average daily call and put. Think of a stock option like a special ticket you can buy for a toy store. This ticket isn't for buying a toy right now, but it gives you a. What is Options Trading? Options trading gives traders more ways to seek opportunities within the asset market. They're a relatively advanced strategy. What are the four basic options strategies? · Long call option: you pay a fixed premium for the right to buy a market at the strike price. · Short call option. Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Choose a strategy. Enter your order. Manage your position. We'll help you build the confidence to start trading options on the E*TRADE web platform or our Power. Options trading is the act of buying and selling options. These are contracts that give the holder the right, but not the obligation, to buy or sell an. Capital Outlay & Cost Efficiency; Risk & Reward; Flexibility & Versatility; Disadvantages of Trading Options. Section Contents Quick Links. Definition. What options are. They are contracts that let you buy or sell an underlying asset (like a stock or ETF). For example, the buyer of an Apple call has. The list below includes some major stocks and exchange-traded funds (ETFs) with heavy options volume. It ranks symbols by their average daily call and put. Think of a stock option like a special ticket you can buy for a toy store. This ticket isn't for buying a toy right now, but it gives you a.

Option trading is a way for investors to leverage assets and control some of the risks associated with playing the market. What are Options: Calls and Puts? An option is a derivative, a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying. An option is a contract that represents the right to buy or sell a financial product at an agreed-upon price for a specific period of time. Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Options trading is the act of buying and selling options. These are contracts that give the holder the right, but not the obligation, to buy or sell an. What options are. They are contracts that let you buy or sell an underlying asset (like a stock or ETF). For example, the buyer of an Apple call has. What Are Options? An option is a contract that gives individuals the right – but not the obligation – to buy or sell a financial instrument. Options must be. Options trading gives the buyer the right but not the obligation to buy (call option) or sell (put option) a certain underlying asset at a predetermined price. Stock options are contracts that give the owner the right -- but not any obligation -- to buy or sell a stock at a certain price by a certain date. Smiling. Options are an investment product that gives you the option to buy a specific stock, bond, commodity or other underlying investment at a specific price on a. Definition and application · An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified. Options are derivative contracts relating to a specific underlying instrument, like a stock, where the contract owner has the choice to buy or sell What are call options? A call option is a contract between a buyer and a seller to purchase a certain stock at a certain price up until a defined expiration. Delta is the theoretical estimate of how much an option's value may change given a $1 move UP or DOWN in the underlying security. Learn more about Delta and. Options are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a. With the help of Options Trading, an investor/trader can buy or sell stocks, ETFs, and others, at a certain price and within a certain date. It is a type of. WHAT ARE OPTIONS? Options are contracts between two parties to exchange an underlying asset at a specific price by a certain expiration date. By combining. Market BasicsOptionsAn option is a type of security that grants the trader the right to buy or sell an underlying asset. The underlying instrument is. Options · Among the lowest options contract fees in the market · Easy-to-use platform and app for trading options on stocks, indexes, and futures · Support from. Option in stock market terms means contract. Options trading contract bestows a trader with the right to buy/sell the underlying assets at a destined price and.

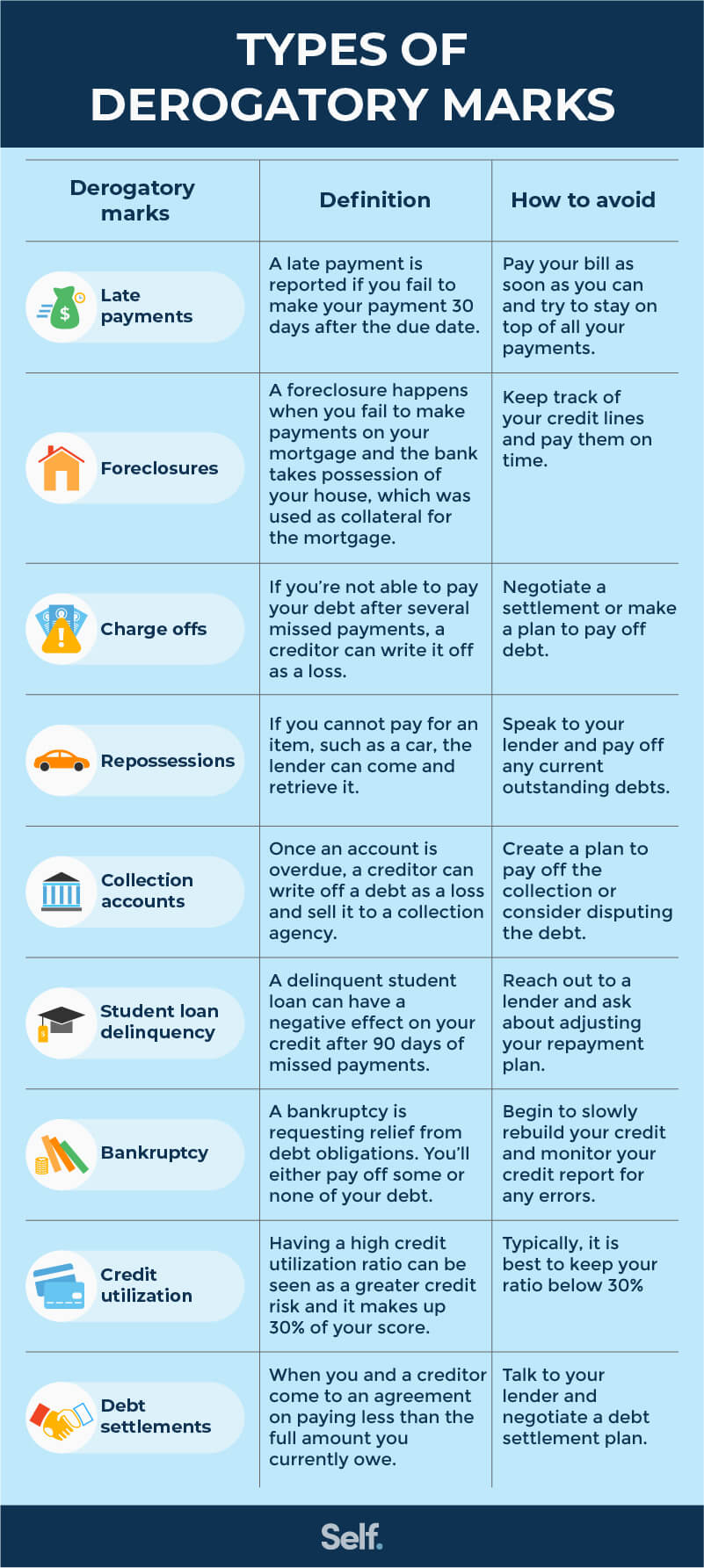

What To Do About Derogatory Marks On Credit Report

A derogatory mark is an indication on your credit report that you failed to make a payment on time. These negative items are among the factors that cause. What should I do if I find information that is inaccurate on my credit report? Federal law allows you to dispute inaccurate information on your credit report. If you spot inaccuracies related to derogatory marks on your credit report from any of the three major credit bureaus, dispute them with the credit bureaus. You. If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file. Mistakes in your credit reports, or fraud caused by iden- tity theft, can make borrowing more expensive or pre- vent you from getting credit. You Can Obtain. Once the credit bureaus receive your dispute letter, they should forward the documents to the creditors in question so the creditors can either challenge the. Derogatory marks on your credit report can significantly impact your creditworthiness, making it more challenging to secure loans or favorable interest rates. Some credit agencies might even offer a pay-for-delete option, where the derogatory mark is removed upon payment. Dispute Errors. Mistakes do happen. If you. Transunion · Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you. A derogatory mark is an indication on your credit report that you failed to make a payment on time. These negative items are among the factors that cause. What should I do if I find information that is inaccurate on my credit report? Federal law allows you to dispute inaccurate information on your credit report. If you spot inaccuracies related to derogatory marks on your credit report from any of the three major credit bureaus, dispute them with the credit bureaus. You. If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file. Mistakes in your credit reports, or fraud caused by iden- tity theft, can make borrowing more expensive or pre- vent you from getting credit. You Can Obtain. Once the credit bureaus receive your dispute letter, they should forward the documents to the creditors in question so the creditors can either challenge the. Derogatory marks on your credit report can significantly impact your creditworthiness, making it more challenging to secure loans or favorable interest rates. Some credit agencies might even offer a pay-for-delete option, where the derogatory mark is removed upon payment. Dispute Errors. Mistakes do happen. If you. Transunion · Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you.

If you find missing accounts, ask your creditors to begin reporting your credit information to credit bureaus, or consider moving your account to a different. File or check on the status of a dispute for free. SUBMIT A DISPUTE CHECK A STATUS. When does filing a dispute make sense for you? If you see something on. You may want to enclose a copy of your credit report with the items in question circled. Send your letter by certified mail with “return receipt requested. Before starting to remove dispute wording, you need to know the following information for each disputed account: · That the account does, for sure, does have to. A derogatory mark is a negative item that appears on your credit report and hurts your credit. A derogatory mark can potentially be removed if you challenge it. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. Derogatory marks on your credit report are financial missteps, such as late payments or bankruptcies, that can make it hard to get approved for new credit. File or check on the status of a dispute for free. SUBMIT A DISPUTE CHECK A STATUS. When does filing a dispute make sense for you? If you see something on. Inaccurate derogatory marks on your credit report can negatively impact your credit score and make it difficult to obtain credit in the future. Fortunately, you. You will first need to verify that your debt has been officially sold, then make a payment plan with the agency that purchased it to settle the debt. This won't. But you might be able to get the late payment removed if you actually paid on time, or if it's more than seven years old. I was able to take. You can dispute the derogatory tradeline with the credit reporting agency. They, in turn will contact the CA for verification. If none of these. Since derogatory marks indicate higher credit risk, they can also impact your credit score, as your credit score is calculated based on the information in your. is an error—for example, if your report incorrectly shows that you're late paying a credit card, make copies of bills or cleared checks (or money order. Derogatory marks on your credit report are financial missteps, such as late payments or bankruptcies, that can make it hard to get approved for new credit. You can negotiate with debt collection agencies to remove negative information from your credit report. 2. Contact the lender reporting the marker Even if you do not have any supporting evidence for your claim, your next step should be to contact the lender. Derogatory credit refers to missed payments, high balances, foreclosures, bankruptcies, charge-offs, and other negative information on your credit report. If you see information on your credit reports you believe is incomplete or inaccurate, a good first step is to contact the lender or creditor directly.

Ford Motor Stock Price Today

View today's Ford Motor Company stock price and latest F news and analysis. Create real-time notifications to follow any changes in the live stock price. Stock price history for Ford (F). Highest end of day price: $ USD on Lowest end of day price: $ USD on NYSE: F ; Price. $ ; Volume. 64,, ; Change. + ; % Change. +% ; Today's Open. $ Get the latest Ford Motor Co (F) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Ford Motor NYSE:F Stock Report ; Last Price. US$ ; Market Cap. US$b ; 7D. % ; 1Y. % ; Updated. 25 Aug, Previous Close ; Week High/Low ; Volume 64,, ; Average Volume 63,, ; Price/Earnings (TTM) View the latest Ford Motor Co. (F) stock price, news, historical charts, analyst ratings and financial information from WSJ. The current price of F is USD — it has increased by % in the past 24 hours. Watch FORD MTR CO DEL stock price performance more closely on the chart. Ford Motor Company Stock Quote. Ford Motor Company (NYSE: F). $ (%). $ Price as of August 23, , p.m. ET. Jump to: Overview. Overview. View today's Ford Motor Company stock price and latest F news and analysis. Create real-time notifications to follow any changes in the live stock price. Stock price history for Ford (F). Highest end of day price: $ USD on Lowest end of day price: $ USD on NYSE: F ; Price. $ ; Volume. 64,, ; Change. + ; % Change. +% ; Today's Open. $ Get the latest Ford Motor Co (F) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Ford Motor NYSE:F Stock Report ; Last Price. US$ ; Market Cap. US$b ; 7D. % ; 1Y. % ; Updated. 25 Aug, Previous Close ; Week High/Low ; Volume 64,, ; Average Volume 63,, ; Price/Earnings (TTM) View the latest Ford Motor Co. (F) stock price, news, historical charts, analyst ratings and financial information from WSJ. The current price of F is USD — it has increased by % in the past 24 hours. Watch FORD MTR CO DEL stock price performance more closely on the chart. Ford Motor Company Stock Quote. Ford Motor Company (NYSE: F). $ (%). $ Price as of August 23, , p.m. ET. Jump to: Overview. Overview.

Ford Motor Co. historical stock charts and prices, analyst ratings, financials, and today's real-time F stock price. Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: Ford Motor Co Frequently Asked Questions · What is Ford Motor Co(F)'s stock price today? The current price of F is $ · When is next earnings date of Ford. Analyst Forecast. According to 10 analysts, the average rating for F stock is "Hold." The month stock price forecast is $, which is an increase of Ford Motor Co. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Ford Motor Company is listed in the Motor Vehicles & Car Bodies sector of the New York Stock Exchange with ticker F. The last closing price for Ford Motor was. Ford Motor Company (F) ; Previous Close ; Volume 7,, ; Avg Vol 60,, ; Stochastic %K · % ; Weighted Alpha Ford Motor Company Common Stock (F). 1D. 5D. Ford Motor · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (+% YoY). About Ford Motor Company (F) ; Price / earnings ratio. x ; Today's range. $ - $ ; Debt / equity. x ; 52 week range. $ - $ ; 5 year debt. Discover historical prices for F stock on Yahoo Finance. View daily, weekly or monthly format back to when Ford Motor Company stock was issued. The latest Ford Motor stock prices, stock quotes, news, and F history to help you invest and trade smarter. Stock analysis for Ford Motor Co (F:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Ford Motor Company ; Prev. Close. ; Low. ; 52wk Low. ; Market Cap. b ; Total Shares. b. Get Ford Motor Co (F'B:NYSE) real-time stock quotes, news, price and financial information from CNBC. View Ford Motor Company F stock quote prices, financial information, real Learn. + %. Today. Current price. USD · PM ET · Aug Ford Motor Company (homedesignlatest.site): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Ford Motor Company | Nyse: F | Nyse. Ford Motor | FStock Price | Live Quote | Historical Chart ; AutoNation, , , % ; Amphenol, , , %. Ford Motor - 52 Year Stock Price History | F · The all-time high Ford Motor stock closing price was on January 14, · The Ford Motor week high stock. Ford Motor (F) has a Smart Score of 6 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.

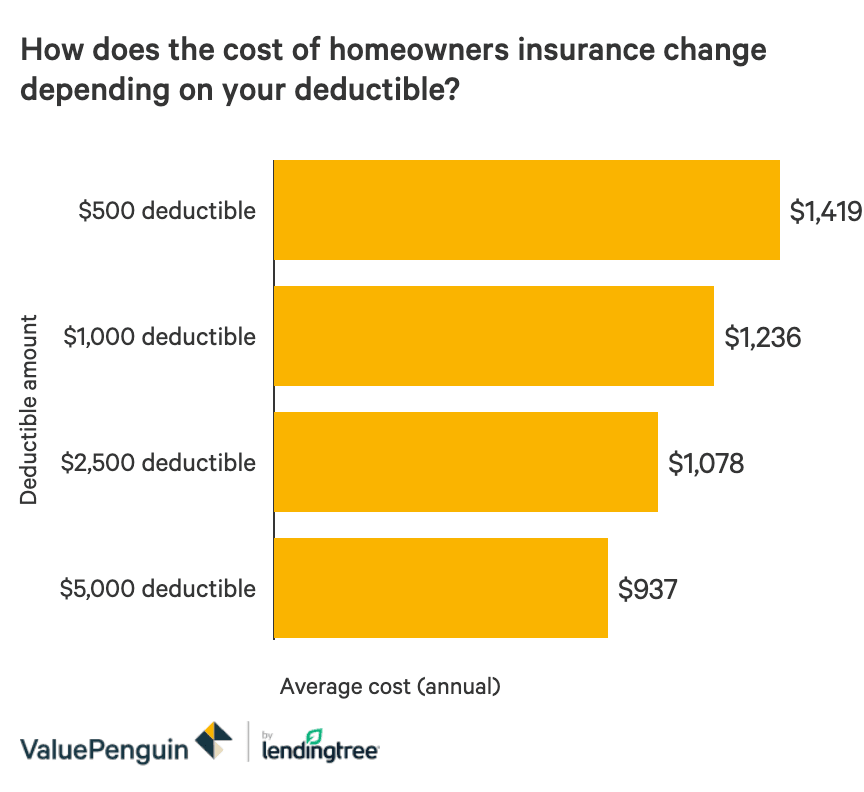

What Is The Average Rate For Homeowners Insurance

Nationally, homeowners pay an average premium of $ per year. The average cost of homeowners insurance in Ohio is $1, per year according to NerdWallet. That's 38% lower than the national average. However, this rate. “The First State” checks in at third for most expensive states to insure a home in, with average annual rates of $1, Budgeting for the monthly cost of. Average homeowners insurance in PA ; Bucks County, $1,, $ ; Montgomery County, $1,, $ ; Philadelphia County, $1,, $ 3Return to reference Average annual per household savings based on a homeowners policy for additional premium, or by purchasing a separate policy. Home Insurance Calculator ; Allstate · 79 · $/mo ; State Farm · 86 · $/mo ; USAA · 86 · $/mo ; Capital Insurance Group · 56 · $/mo ; Travelers · 69 · $/mo. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. Average homeowners cost by coverage amount ; $,–$, $ ; $,–$, $ ; $,–$,. $1, ; $,–$, $1, The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which. Nationally, homeowners pay an average premium of $ per year. The average cost of homeowners insurance in Ohio is $1, per year according to NerdWallet. That's 38% lower than the national average. However, this rate. “The First State” checks in at third for most expensive states to insure a home in, with average annual rates of $1, Budgeting for the monthly cost of. Average homeowners insurance in PA ; Bucks County, $1,, $ ; Montgomery County, $1,, $ ; Philadelphia County, $1,, $ 3Return to reference Average annual per household savings based on a homeowners policy for additional premium, or by purchasing a separate policy. Home Insurance Calculator ; Allstate · 79 · $/mo ; State Farm · 86 · $/mo ; USAA · 86 · $/mo ; Capital Insurance Group · 56 · $/mo ; Travelers · 69 · $/mo. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. Average homeowners cost by coverage amount ; $,–$, $ ; $,–$, $ ; $,–$,. $1, ; $,–$, $1, The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which.

Average homeowners insurance in NJ ; Bergen County, $1,, $ ; Burlington County, $1,, $ ; Camden County, $1,, $ According to our analysis of New York rates, homeowner's insurance costs an average of $1, per year, or $ per month, for a policy with $, in. Affordable home insurance that helps you save. Bundle auto and homeowners insurance. Save an average of 7% on car insurance when you combine Progressive home. How much does homeowners insurance cost? The average premium for an HO-3 policy, the most common homeowners policy, is around $1, per year for a package. The cost of homeowner's coverage depends largely on where you live. Crime rates vary from community to community, as does access to your local fire department. Rates vary by individual factors, but homeowners insurance premiums can cost more than $2, per year. 59% of Zebra customers visiting this page believe they. Average Homeowners Losses, (1) · About one in 18 insured homes has a claim. · About one in 35 insured homes has a property damage claim related to wind. How much does homeowners insurance cost? The amount you pay for home The typical homeowners or rental property insurance policy doesn't include. According to the Insurance Information Institute (III), the average American homeowner pays just under $1, per year for a home insurance premium. However. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded to. According to the latest data, the average cost of homeowners insurance in the United States is $1, per year. That said, insurance premiums can vary. How much does home insurance cost? Find out how much you can expect to pay monthly or yearly so you're prepared to shop and save. The average home insurance cost of $, in coverage is $3, per year. According to a recent data analysis, Allstate offers the cheapest average annual. The premiums charged for homeowners and tenants insurance vary widely from company to company. Consumers should shop around in order to get the best value. How much does homeowners insurance cost? The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on. The average annual rate increased by % between and , from $1, to $2, Insurify projects a 6% increase in , placing rates at $2, by the. While costs of $3, to $3, per year may sound high, they may be reasonable considering the value of the home is $, Here are some. costs in your area. However, certain conditions such as severe weather can increase the demand for labor and materials and raise costs beyond normal inflation. The price of a typical homeowners insurance policy in the U.S. rose about 10 percent in , according to the Insurance Information Institute, an industry.

Claiming Personal Bankruptcy

What is bankruptcy? Bankruptcy is a legal process to help people who owe money, or debtors, get relief from debts they cannot pay and, at the same time. How might my bankruptcy impact me as a debtor? Individuals can file either Chapter 7 bankruptcy or Chapter 13 bankruptcy. Here is how the two types work and some alternatives to consider first. When to file bankruptcy and determining if it is the right choice for you ultimately depends on your individual circumstances. In this post, we'll cover these. Personal Bankruptcy: A legal process through which an individual who cannot pay their bills can eliminate debt. Small Business Bankruptcy: A legal process. You can apply to have your address (and some other information) hidden from the National Personal Insolvency Index (NPII) if you believe your safety is at risk. It might be time to declare bankruptcy, if, for example, you have large debts that you can't repay, are behind in your mortgage payments and are in danger of. Personal: You are still required to file personal income tax returns after filing for bankruptcy. Your bankruptcy representative may also be required to file. If you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Other options include an IRS payment plan or an offer in compromise. What is bankruptcy? Bankruptcy is a legal process to help people who owe money, or debtors, get relief from debts they cannot pay and, at the same time. How might my bankruptcy impact me as a debtor? Individuals can file either Chapter 7 bankruptcy or Chapter 13 bankruptcy. Here is how the two types work and some alternatives to consider first. When to file bankruptcy and determining if it is the right choice for you ultimately depends on your individual circumstances. In this post, we'll cover these. Personal Bankruptcy: A legal process through which an individual who cannot pay their bills can eliminate debt. Small Business Bankruptcy: A legal process. You can apply to have your address (and some other information) hidden from the National Personal Insolvency Index (NPII) if you believe your safety is at risk. It might be time to declare bankruptcy, if, for example, you have large debts that you can't repay, are behind in your mortgage payments and are in danger of. Personal: You are still required to file personal income tax returns after filing for bankruptcy. Your bankruptcy representative may also be required to file. If you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Other options include an IRS payment plan or an offer in compromise.

You can file bankruptcy even if there is equity in your home. If you owe more money to your creditors than the value of what you own you are considered. Many debtors who file for Chapter 7 bankruptcy are pleased to learn that they can keep some of their personal property. If you owe money on a secured debt (for. At the end of the bankruptcy, most debts are cancelled. How you become bankrupt. The High Court can declare you bankrupt by making a 'bankruptcy order' after. When you file personal bankruptcy, it will stay on your credit report for ten years. You will start your credit history again like it never. Facing overwhelming debt? Discover how bankruptcy can offer a fresh start. Understand your options and take the first step towards relief today. The answer is: In most cases they can file for personal bankruptcy and keep their business active. However, filing for bankruptcy in some situation can be more. The last step of the bankruptcy process is discharge from your debts. To be discharged means that the debts included in your bankruptcy are erased since all the. A business entity filing bankruptcy does not protect the individual nor make the individual's debts subject to discharge. Likewise, an individual filing. 1. What Is It—And How Does It Work? · 2. What Are the Different Kinds of Bankruptcy Cases? · 3. Who May File for Bankruptcy? · 4. Do I Have to Go to Court? · 5. How. Pass a “means test”: This will determine whether you are eligible to file for Chapter 7 bankruptcy. If your income is below the median income in your state, you. In a bankruptcy case under Chapter 7, you file a petition asking the court to discharge your debts. The basic idea in a Chapter 7 bankruptcy is to wipe out . Most bankruptcy petitions are voluntary. The definition of a debtor who may file bankruptcy can be found in the Bankruptcy Code. Deciding whether to file. Properly filing for bankruptcy takes careful preparation and knowledge of the law. The bankruptcy laws are complex and debtors who fail to comply with the. The bankruptcy law allows a married person to file an individual bankruptcy but there will be some impact on the non-filing spouse. If you have already filed bankruptcy under chapter 7, you may be able to personal injury caused by driving drunk or under the influence of drugs. When you declare bankruptcy, you will file a petition in federal court. Once your petition for bankruptcy is filed, your creditors will be informed. If you have a large amount of equity in your home that is outside the exemption values, you do not want to file a Chapter 7 because the equity would not be. Yes, employed people can file for bankruptcy and often do. Your employment income will play a role in determining whether you can file Chapter 7 bankruptcy. If you file for Chapter 7, these debts will remain when your case is over. In Chapter 13, you'll pay these debts in full through your repayment plan. Debt. How to File Bankruptcy: A Step-by-Step Guide · Step 1: Consider Your Financial Situation · Step 2: Contact a Licensed Insolvency Trustee (LIT) · Step 3: File the.

Rules Of 529 Plans

Get answers to the most common questions about the Future Scholar College Savings Plan: contribution limits, set up, rules, withdrawing funds and more. Funds may also be used to pay for K tuition and apprenticeship expenses. You can open your account with as little as $1. Saving just $ has proven to. For information on a special rule that applies to contributions to plans, see the instructions for Form , United States Gift (and Generation-Skipping. A beneficiary is the person whose future college costs can be paid from the account. An account can be opened for a child, grandchild, friend, or even. The Tax Cuts and Jobs Act was signed into law in December This federal law allows families to use plans to pay for up to $10, in tuition at private. Who Can Participate in Plans? Under federal tax law, an account in a state's savings plan may be opened by any person on behalf of any individual. The only rule is that the account must have a living beneficiary. You can open a plan for a child and keep money in the account until they're 80 years old. This means in contributions up to $18, a year, or $36, for married couples are gift tax free. Special rules allow a gift giver to make a lump sum. You can spend up to $10, from a plan on tuition expenses for elementary, middle, or high school Year after year, you and your child have been saving. Get answers to the most common questions about the Future Scholar College Savings Plan: contribution limits, set up, rules, withdrawing funds and more. Funds may also be used to pay for K tuition and apprenticeship expenses. You can open your account with as little as $1. Saving just $ has proven to. For information on a special rule that applies to contributions to plans, see the instructions for Form , United States Gift (and Generation-Skipping. A beneficiary is the person whose future college costs can be paid from the account. An account can be opened for a child, grandchild, friend, or even. The Tax Cuts and Jobs Act was signed into law in December This federal law allows families to use plans to pay for up to $10, in tuition at private. Who Can Participate in Plans? Under federal tax law, an account in a state's savings plan may be opened by any person on behalf of any individual. The only rule is that the account must have a living beneficiary. You can open a plan for a child and keep money in the account until they're 80 years old. This means in contributions up to $18, a year, or $36, for married couples are gift tax free. Special rules allow a gift giver to make a lump sum. You can spend up to $10, from a plan on tuition expenses for elementary, middle, or high school Year after year, you and your child have been saving.

Under IRS rules, you can change your investment mix only two times per year. Unlike prepaid tuition plans, savings plan don't lock in tuition prices, nor. A account can be opened by anyone. Grandparents, other relatives or family friends can all be account owners, or simply choose to contribute to an existing. ACCOUNTS HAVE LONG BEEN A POPULAR WAY to set aside funds for education. They allow you to invest money for a beneficiary, and when the student is ready. The tax consequences of using Plans for elementary or secondary education tuition expenses will vary depending on state law and may include recapture of tax. Typically, you can contribute up to $18, a year (or $36, for couples) to one or more college savings plans without incurring the gift tax. But it's. The first rule is that the expense must be necessary for enrollment/attendance. Tuition, books, supplies, and equipment are the most obvious. Section plans are offered by states under the federal tax code and may provide significant tax advantages to parents and others who save for future higher. A plan is a tax-advantaged account made specifically for education savings—like colleges, trade schools, and vocational schools. Anyone can open a college savings plan. You can set anyone as the beneficiary—a friend, son, daughter, grandchild, or yourself. No income restrictions limit. plan assets are counted at different rates for the Expected Family Contribution (EFC) in the FAFSA formula. Current federal guidelines are as follows: If. How much can I invest? The Maximum Account Balance is currently $, If your Account has reached the Maximum Account Balance, it may continue to accrue. When you pay qualified education expenses from a account, your withdrawals are federal-income-tax- and penalty-free. As of , qualified expenses include. Under IRS rules, you can change your investment mix only two times per year. Unlike prepaid tuition plans, savings plan don't lock in tuition prices, nor. Federal tax laws passed in , , , and added several new tax benefits to plans. · plans can now be used for K–12 expenses, not just for. With a education savings account, you may make withdrawals from the beneficiary's account for higher education expenses at any time and in whatever amount. Most plans cover expenses for out-of-state schools, but rules may vary by plan. Who can open a account? Generally, anyone can open a account as long. Rollover unused funds in a college savings plan account to a Roth IRA maintained for the same account beneficiary. The plan account must have been. Although the money may come from multiple college savings plan accounts, it will be aggregated on a per-beneficiary basis, and any distribution amount in. Start an education fund for your children or a family member with a Schwab Education Savings Plan. You can open and contribute to almost any plan. A savings plan works in some respects like a Roth retirement savings plan. This kind of allows account holders to open an account and invest after-tax.

2 3 4 5 6 7